SolarWorld is only the latest bankrupt PV manufacturer in Germany. Many now wonder: What is the matter with photovoltaics in Germany and what is next? When trying to answer these questions, we have to look at three sectors: Politics, economy and technology. In the technical and economic sector, photovoltaics (PV) is on a triumphal march worldwide. Along with wind energy, it will be a keystone of the climate-friendly energy supply of the future. However, the capital-oriented market economy does not regard the fact that a local and sustainable production of solar modules is important.

What happened?

China is not only the biggest manufacturer but also the largest market for photovoltaics worldwide. In 2016, China’s frenzied pace at which it has been expanding its ground-mounted PV power plants has led to the fact that the government-given targets were reached faster than scheduled and that there was an energy surplus that the grid could not absorb. In 2016, a total of about 34 GW have been installed in China. This represents an increase of 126% compared to the prior year. As a result, at the beginning of 2017, it has been more difficult to get permissions for ground-mounted photovoltaic power plants and less PV systems have been installed in China. Only 7 GW in the first quarter – sales in China declined! Manufacturers have massive overcapacities and offer prices that are lower than the production costs. This wave of price reductions came to Europe in spring 2017 and also took SolarWorld down. After the first wave of bankruptcies, the group has reorganized quite well and just invested millions for the upgrade to the future technology PERC solar cell (Passivated Emitter Rear Contact). This means the transition from the globally dominating multicrystalline silicon to monocrystalline material and complex new process steps for the backside contact. Overall, it is evident that this technology will be the workhorse of the next generation. At this stage, liquidity was too weak to withstand the second price drop.

In China, too, there have been bankruptcies in recent years, but given the dominance of the Chinese PV industry there have been no noticeable market shakeouts. This economic development mainly relates to a clear policy aim: Renewables should satisfy China’s hunger for energy and, at the same time, be an important export product. For this, the Chinese government consistently provides capital and the regulatory framework. In Europe, there are also objectives like the Paris agreement on a global energy revolution but actions are missing: In order to achieve the PV objective, a PV capacity of at least 6 GW has to be installed in Germany every year (instead of only 1.5 GW in 2016).

What is the situation on the world market like?

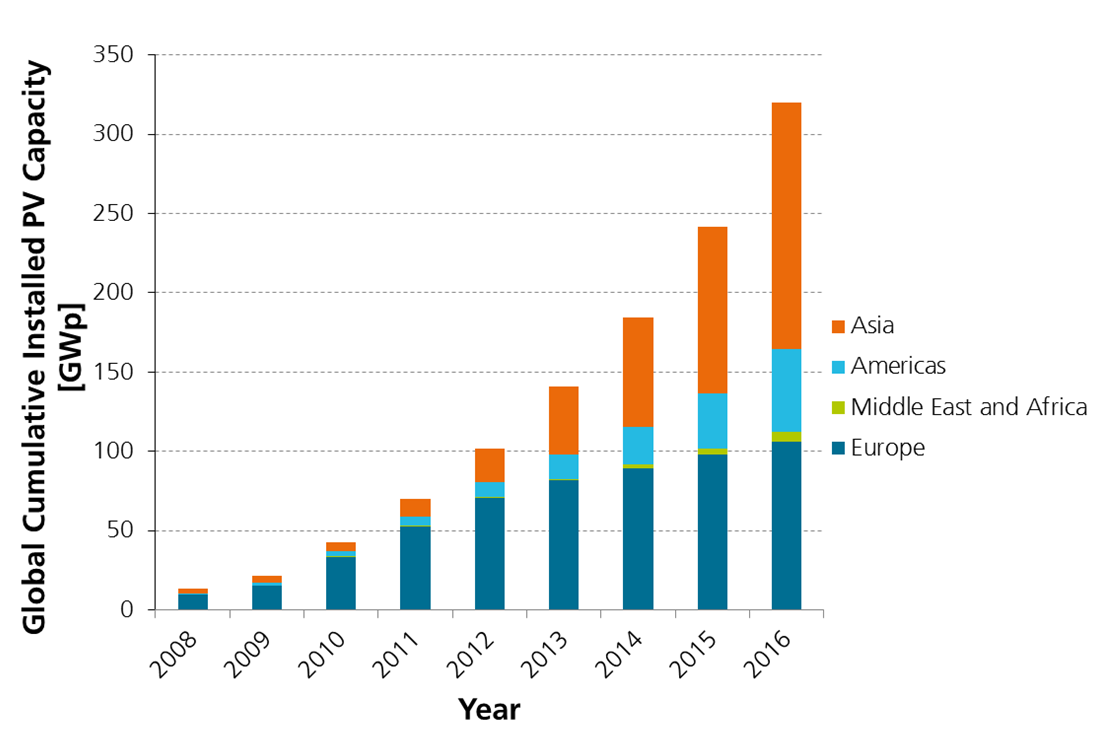

The global PV capacity was about 75 GW in 2016. The total capacity installed equals already one third of the terawatt goal. Module prices just go down to 0.4€/W and even 0.3€/W have already been offered. In China itself prices below 0.25€/W have been obtained. Figure 1 shows the largest manufactures and sales markets. China is by far the most important market, followed by the USA. India and South America could also show a rapid market growth soon.

Approximately 69% of the produced modules consist of multicrystalline silicon, 24% of mono-silicon, about 6% of cadmium telluride (CdTe) and about 1% of copper indium selenide (CIS). The last two materials are thin-film cells which, among other things, provide particular advantages for building integration. The characteristic efficiency of modules made of multicrystalline silicon is 17 to 19%. The efficiency of mono-silicon is 1-2 percentage points higher.

There are two major trends in this technology development: Costs for solar cells decrease, efficiencies increase. As the remaining system costs like glass, steel, mounting, cables do not decrease to the same extent, efficiencies are increasingly important. At appropriate quantities, even high-quality material and complex cell structures are no longer a barrier to mass products. The PERC cell originally was an exotic high-performance cell which now has best chances to become standard technology.

Which technical innovations emerge next?

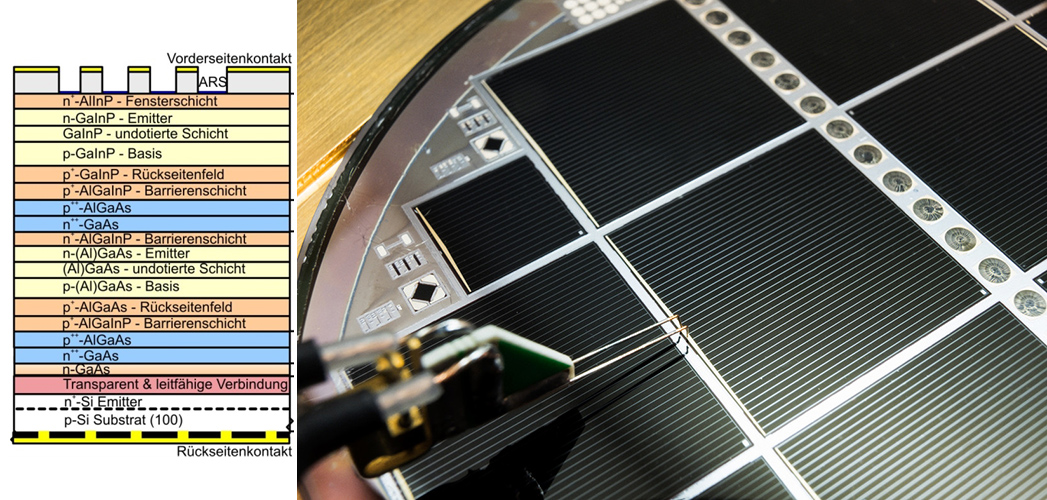

Research is five years faster than production. The theoretical limit for the efficiency of silicon is 29.4%. The Japanese manufacturer Kaneka currently holds the world record with 26.6% (certified by the CalLab PV Cells of the Fraunhofer ISE). The target is 27%. To exceed this target, different material and/or concentration (CPV Concentrated Photovoltaics) will be needed. The absolute world record for PV cells is currently held by the Fraunhofer ISE with a four-junction cell that consists of semiconductor material with elements of the third and fifth group of the periodic table (III-V material). The efficiency is 46.0% at a concentration of 508 suns. This technology was developed by Soitec and enjoyed a very successful market launch. But here again, problems regarding liquidity arose. From a technical point of view, a further development would be possible and reasonable at any time.

Another branch of research, which is gaining more and more importance, is the combination of the proven silicon for the long-wave radiation with another material which is efficient in blue solar cells. This could be III-V semiconductors or perovskites.

The III-V technology has not only been evaluated for a long time but also has continually been further developed. In practice, it has captured the market for applications in space. On earth, such cells are used in concentrator systems. Researchers have been working on a combination with silicon for a long time. A combination of gallium indium phosphide and gallium arsenide with silicon to a monolithic triple-junction solar cell recently succeeded at the Fraunhofer ISE and a record efficiency of 31.5% could be reached.

Perovskite is the name for a crystalline structure which only recently found a new purpose in photovoltaics but has already been developed at a breathtaking pace. In three to five years, it may be possible to reach the same quality as with III-V materials. Perovskites could also offer cost advantages as they evaporate like thin-film cells or could be applied like organic solar cells from one solution. There are still two major hurdles to overcome: The lack of transparency limits the efficiency and an unexplained stability limits the durability.

Both for perovskites and III-V materials problems can be overcome. The target is over 30% with silicon as a basis.

Does PV pay off in Germany?

Even in the year 2012, Germany has been the most important sales market. Today it hardly plays a role anymore. This is mainly due to the massive changes to the German Renewable Energy Sources Act (EEG). Not only the level of feed-in but also the introduction of charges for self-consumption and a general uncertainty about the legal situation curbed the enthusiasm of the broader population.

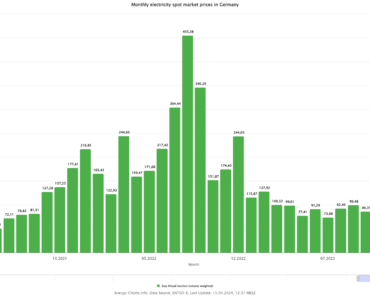

Rational reasons for why there are no big German PV manufacturers anymore can be found in commerce and politics. Explaining the drop in demand is more difficult. Since the great irony of the solar success story in Germany is that it came to an end in the moment when photovoltaics fell below grid parity. This means production costs without any support have been lower than the electricity price for end and commercial customers!

To answer the question whether PV pays off in Germany: It has always paid off and is particularly worthwhile at the moment as solar power is cheaper like never before: Ground-mounted power plants reach production costs of 0.6€/kWh in Germany. This is comparable to new coal-fired power plants. The British nuclear power station Hinkley Point reaches 0.10€/kWh.

For rooftop installations, end customers can expect 0.8 to 0.10€/kWh and complete installations can be realized for 1,300€/kW. In addition, there are plummeting storage prices. So, this way to increase the level of self-consumption can also be developed economically.

How should a PV production in Europe look like?

The good news is: Due to its high degree of automation, PV can be produced at similar Chinese costs in Germany and Europe, provided that the purchase prices for material are the same. And these depend on quantity. A corresponding production should have at least an output of 1 GW which can be expanded to a double-digit GW range. The question is who is willing to make such investments? Investors would need more security and this means clear political support.

The longer they wait, the bigger the step. Soon, 10 and more gigawatt will be the lower threshold for a profitable production. If there is no rethinking in Europe, this will not be the last innovation which, sooner or later, will be produced in Asia. But the German automotive and aviation industry are good examples to show success stories.

The most important argument: If we do not establish our own PV production, we will be dependent from foreign producers. This is already the case with oil and gas. The development of a sustainable PV production would be a strategy that is a good match to the role of Europe as a technology driver: Our PV research landscape is still leading worldwide. We could bring up a production with technologies of tomorrow and be strongly positioned on the global market when the leading production facilities of today are outdated. This will be the case in five years at the latest!

Conclusion

Globally, PV is at the beginning of its triumphal march. Even in Germany it pays off more and more. Science and technology will do their homework and PV will meet a major part of our energy demand. It is another question whether the European economy can benefit from it. This question can be answered by politics which, in case of democracy, we decide on.

Add comment